With the pandemic still present, the economy is still struggling due to keep up with the losses caused by it. One of its great impact is on the real estate industry. The decrease in the number of people looking for a new place and the limited movement brought about by the previous restrictions due to COVID-19 greatly decreased the income of real estate companies causing a downward trend to the prices of properties.

Negative Equity

Negative equity happens when the value of the real estate property under mortgage is worth less than the mortgage secured on it. This often occur when the property prices are falling due to a recession or an economic depression. Negative equity is calculated by simply knowing the current market value of the property and subtracting the amount remaining on the mortgage. For example, if you bought a property for £200,000 with a mortgage for £ 180,000 and now the market value of the property is only £ 150,000 then you will be in negative equity. This is not good news for real estate agents and borrowers as it decreases the market value and their possible income from selling these properties.

Economic Implications

As negative equity happens when a person bought a house prior to a depression or recession, in this case the unpredicted COVID-19 pandemic, causing the current market value to be below the mortgage. They also use the term “underwater” to refer to borrowers or property owners as having a negative equity if they want to sell their properties at this time.

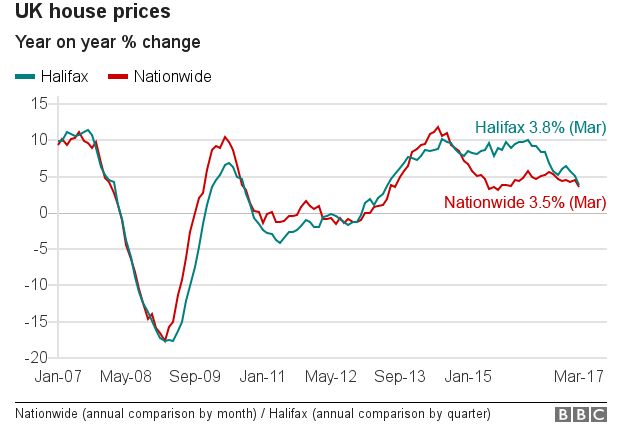

Negative equity has been a common problem of homeowners during the 2007-2008 financial crisis. Homeowners were affected by this found themselves unable to actively pursue work in other states or areas because of the potential losses that they can incur from the sale of their homes.

Selling a Home

If you are planning to sell a property, now may not be the best time as property prices are falling. Unless you have an available savings in the bank or investments that you can use to repay the difference between the market value and the mortgage, then you might find it difficult for you to move to a different place, state or country. Some banks may offer remortgage, but you may have a hard time finding one or if you find one, they might have a fixed rate.

Pros and Cons of Negative Equity Mortgage

Pros:

- Moving houses does not require you to pay off the negative equity on your mortgage. This particularly useful if you really need to move and you can’t stop it.

Cons:

- Moving might cause you to pay your repayment charges early on your existent mortgage.

- Fees and charges may be added, and a new mortgage might have a higher interest rate compared to the previous one.

- There are only a limited number of lenders that offer this type of scheme and they often have different requirements before they approve your mortgage.

Reduce your Negative Equity

Reducing your negative equity is possible. This is done by simply overpaying the monthly amount due on your current mortgage. Before doing this, make sure that your existing mortgage accepts overpayments and if so, how much can you add to your payment without incurring an early repayment charge. Make sure to keep your income or savings in check prior to doing this as it is and added expense.

Renting out

If you don’t need immediate money but would like to move due to some personal reasons, you can consider renting out your home. This means that you are still keeping and paying the existing mortgage, but it may have a higher interest than your usual.